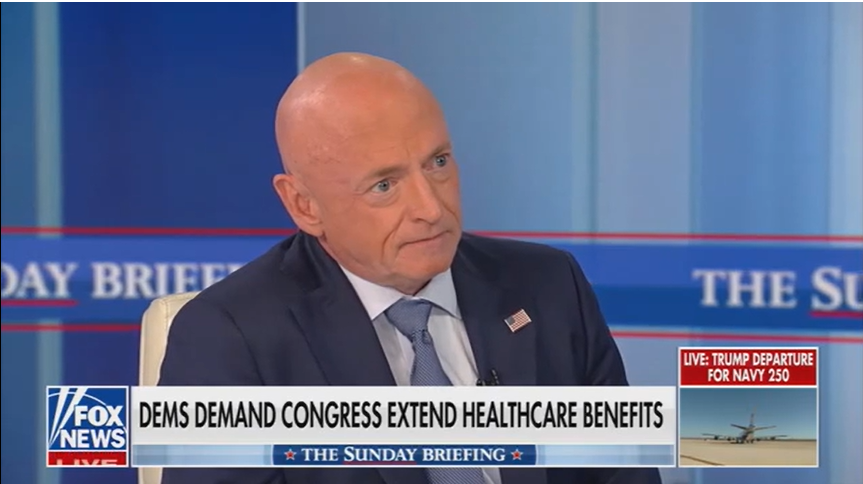

ICYMI: On Fox News’ The Sunday Briefing, Kelly Puts a Face to the Threat of Higher Health Care Costs

“This is about real people who are going to see the price of health care skyrocket.”

In case you missed it, Arizona Senator Mark Kelly joined Fox News’ The Sunday Briefing today to make clear what the current fight in Washington is all about: the price Americans pay for health care.

Kelly has been hearing from constituents who would be affected by higher premiums and shared the story of Robin, a 60-year-old Arizonan who will not be able to pay for her health care anymore if Congress doesn’t act on the Affordable Care Act tax credits, which have been a lifeline for her and expire in weeks.

Watch the full interview here. See key excerpts below:

On what higher health care premiums would mean for Americans…

“Her name’s Robin. She’s on a fixed income, she’s 60 years old, and a fifth-generation American. She said to me, ‘Why are they making this about immigrants? This isn’t about immigrants. This is about me.’ She pays $250 a month for health care but gets around $9,000 in those premium tax credits. She is expecting if we do not act on this, that is going to go away, and she says she will not be able to afford health care anymore. This is about real people who are going to see the price of health care skyrocket.”

On the stakes if Congress fails to act…

“On November 1st, individuals are going to get these letters, some already have. There are folks in Alaska who have received letters saying their premiums are going from $600 a month to $4,000. That’s unaffordable. In my state, in Arizona, 109,000 people are likely to lose their health care, meaning that they’re one accident or one illness away from bankruptcy.”

On Republicans’ responsibility to end the shutdown…

“I’ve talked to them [Republicans] about this. They understand that this is a real problem affecting the people they represent, and we know how to solve it. The president could work with Senator Thune and Speaker Mike Johnson and say, ‘We’re going to extend these tax credits for two or four years,’ and then come up with a better plan.”